Navigant Corporate Advisors Ltd (NCAL), a boutique advisory firm based in Mumbai, is seeking to raise Rs.1.19 Crore through its initial public offering. The company has fixed the price for its initial share sale at Rs 14 and it will run from 30th Nov’15 to 7th Dec’15.

A glimpse of Navigant Corporate Advisors:

Navigant Corporate Advisors is engaged in the financial services business like: Advsiory in IPO, Listing on Stock Exchanges, Mergers & Acquisitions, Debt Syndications, Takeovers, Valuation Reports, Cross Border Structures, Tax Management, Strategic & General Corporate Advice, Business Modeling etc. Primarily they are focused on small and mid sizes enterprises (SMEs).

NCAL was promoted as real estate company under the name of S P Realtor Estates Ltd, that later ventured into corporate advisory, merchant banking allied activities etc. It rechristened itself to present name.

Issue Details:

- Issue Open: 30th Nov’15 – 7th Dec’15

- Issue Type: Fixed Price Issue IPO

- Face Value: Equity Shares of Rs. 10

- Issue Size: Rs. 1.19 Crore

- Issue Price: Rs. 14 per share

- Minimum Shares: 10,000 Shares and in multiple of 10,000 there-of

- Minimum Amount: Rs. 1,40,000

- Listing: BSE SME

- Download NCAL IPO Prospects at this link

Company’s Promoters:

The promoter of the company is Mr. Sarthak Vijlani.

Also Read: How to become a Good Investor

Objectives of the IPO:

The Issue comprises the Fresh Issue and Offer for Sale:

1. Listing benefits;

2. Increase visibility & brand name;

3. To provide liquidity to the existing shareholders.

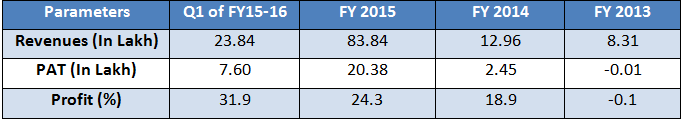

A close look on the Financials of the Company:

From above table its clear that company is growing at very fast speed. Its EPS for FY 2015 is Rs. 3.37 and last 3 years average EPS is Rs. 1.93.

Reasons to Invest in NCAL IPO:

- Revenue is growing at rapid speed. Growth in revenue is 10 times in last 3 years.

- Profit Margin is good. Earning 25% profit in SME companies that came for IPO is very less.

- Huge potential to growth as right now they are focused in Mumbai only.

Also Read: Types Of Mutual Funds In India

Reasons to NOT to Invest in Indigo IPO:

- They posted loss 2 years back i.e., in FY 2013.

- Company is more dependent on higher management for success which can be negative if something happens to the management.

- If company will not be able to sustain this growth rate; it will directly affect the profit.

- Company is majorly focused in Mumbai, needs to expand in other areas as well. If they fail to do so, it can be a huge negative for the company.

- Company don’t have registered office.

Investment Strategy:

At an issue price of Rs. 14 its P/E ratio is 4.1 at EPS of Rs. 3.37 whereas on 3 years average EPS of Rs. 1.93; the P/E ratio is 7.2. The industry average P/E ratio is 22.1 whereas lowest P/E ratio is 2.1 and highest P/E ratio is 242. Hence, issue seems to be reasonably priced.

Company is growing with a good speed but it comes with its own risk as mentioned above. If you can evaluate risk involved with this IPO; I would recommend investors to subscribe to the same.

Disclaimer:

Investing in this IPO does not interest me much. The idea of enlisting positive and negative sides to investor in this articles is to create awareness and educate about this IPO. Please consult your investment adviser before you invest in such high risk investment option.